5 Simple Techniques For Paul B Insurance Medicare Advantage

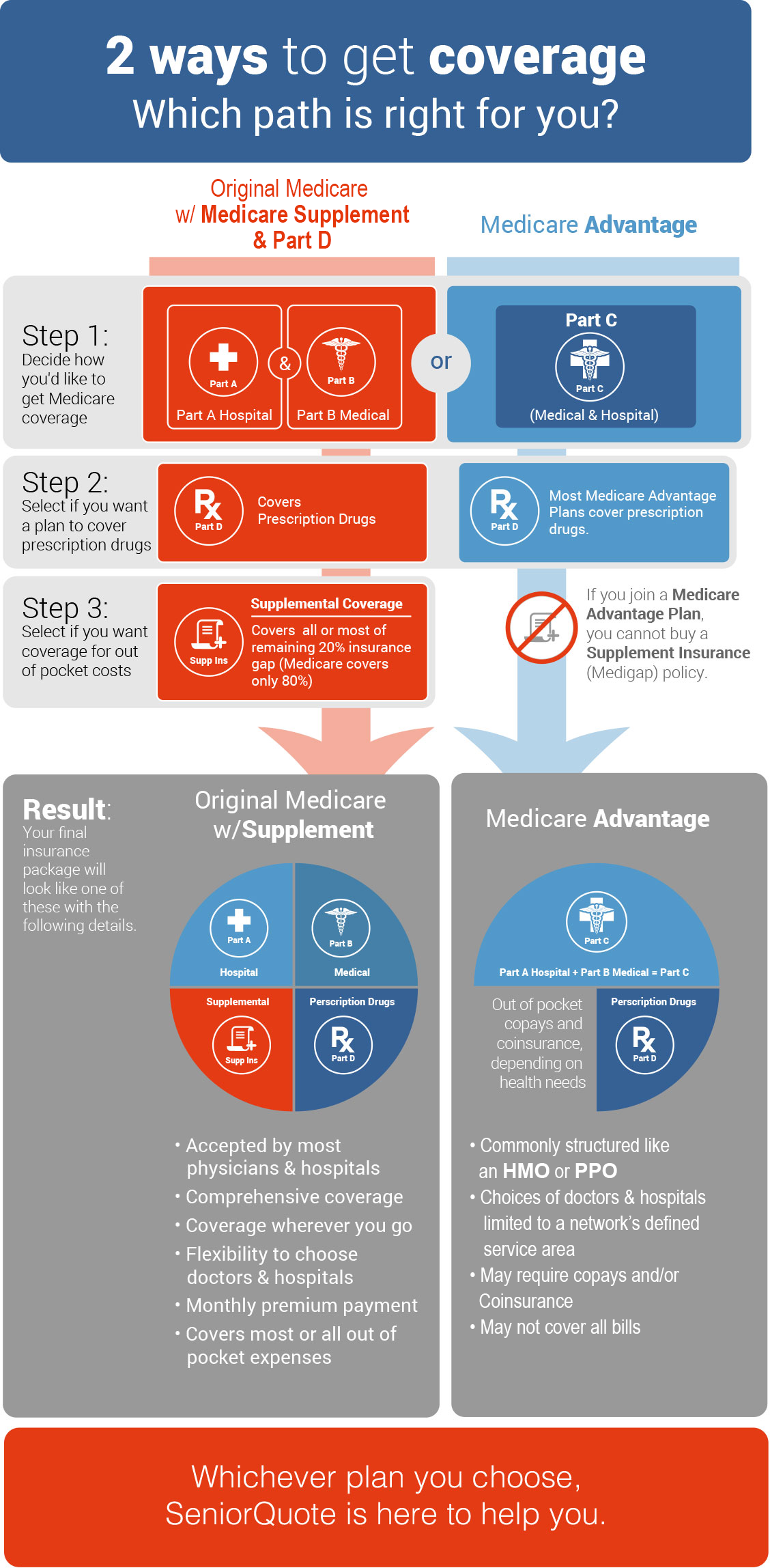

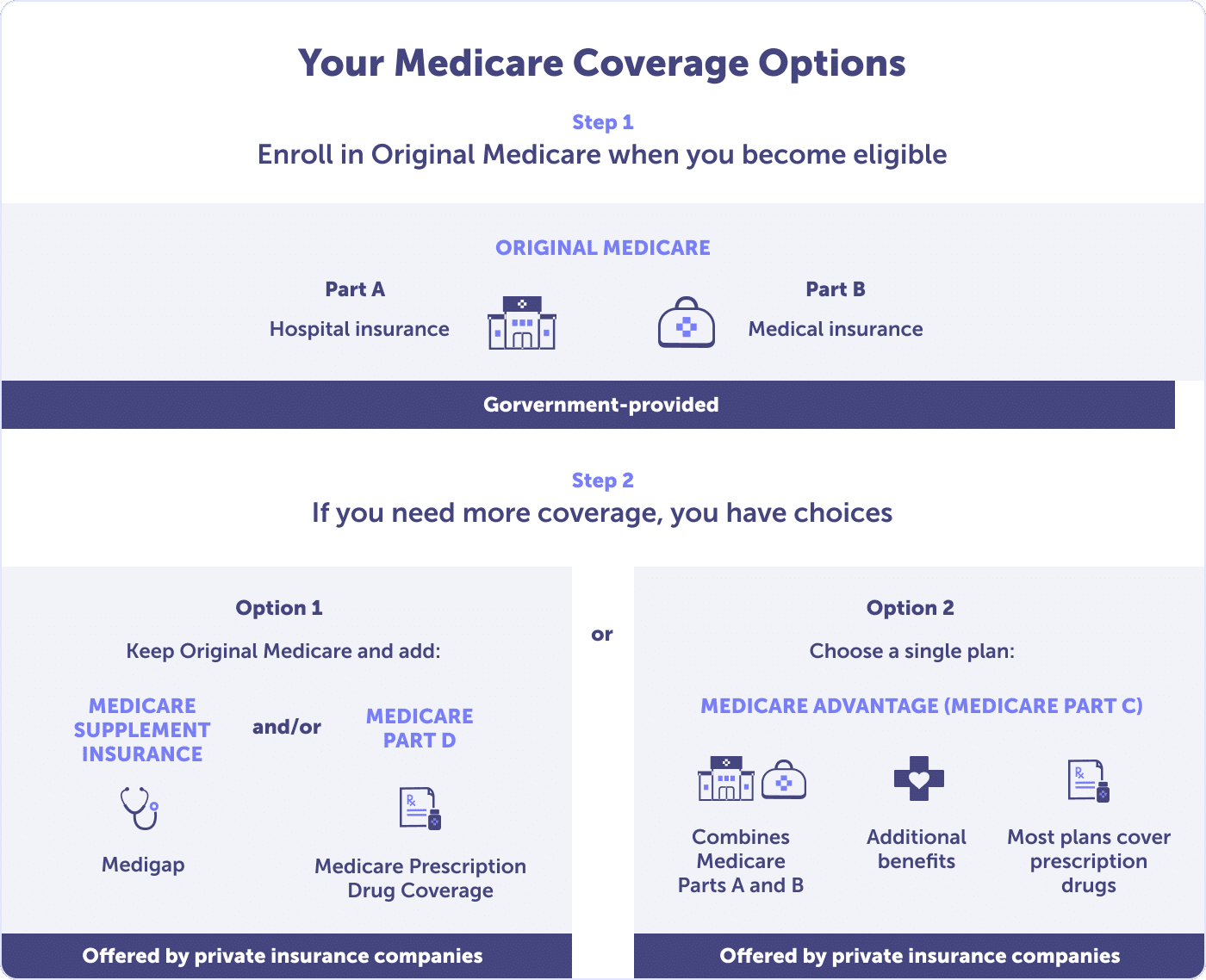

No. Beneficiaries can see any provider in the nation that accepts Medicare. Foreign travel, Plans do not cover foreign travel health expenditures. A few of the plans cover foreign travel health costs. Beneficiaries can have both Medicare and employer-sponsored health insurance at the very same time. The size of the company identifies primary and secondary coverage.

In other words, a chronically ill beneficiary would probably benefit more by having the more comprehensive variety of providers provided through Original Medicare and Medigap. Medicare Advantage plans are best fit for healthy recipients who don't use lots of health care services. With a Medicare Benefit strategy, this type of policyholder might come out ahead, paying little in the way of premiums and copays while benefiting from advantages to stay healthy such as fitness center memberships, which are offered as part of some plans.

The Best Strategy To Use For Paul B Insurance Medicare Advantage

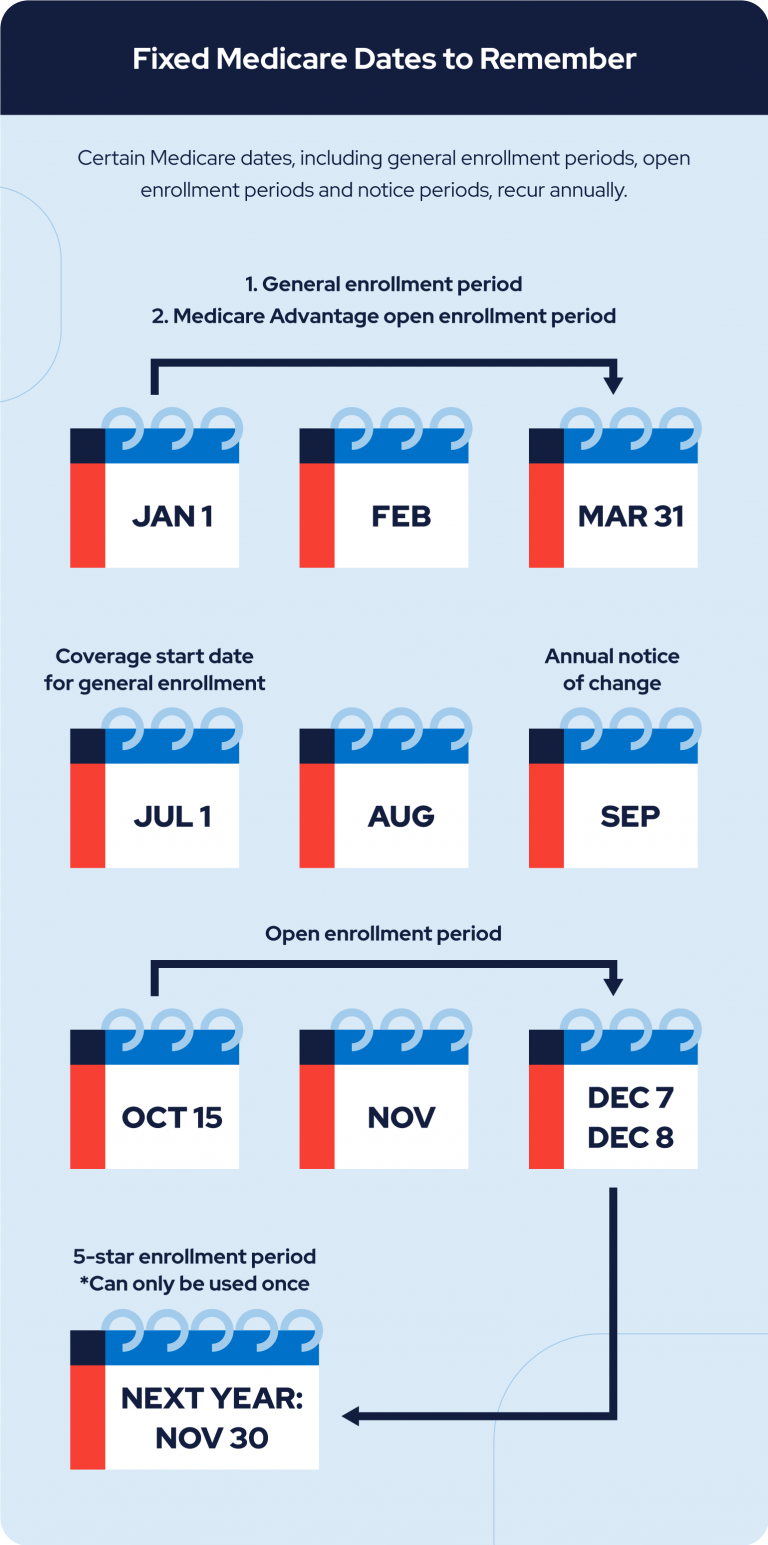

If you choose not to register for Medicare Part B but then choose to do so later, your protection could be postponed. You may need to pay a greater regular monthly premium for as long as you have Part B. Your monthly premium will go up 10% for each 12-month duration you were eligible for Part B however didn't sign up for it.

If so, you may wish to ask your personnel workplace or insurance company how registering for Medicare will affect you. You might have medical insurance coverage under a group health plan based on your or your spouse's existing employment. In this case you might not require to get Medicare Part B at age 65.

Paul B Insurance Medicare Advantage Can Be Fun For Anyone

The 8-month duration that begins with the month after your group health insurance coverage or the employment it is based on ends, whichever comes initially. Are you within 3 months of turning age 65 or older and not prepared to begin your month-to-month Social Security advantages? You can use our online application to sign up simply for Medicare and wait to obtain your retirement or partners benefits later.

Return to Saved Application Inspect Application Status Change Medicare Card To discover out what documents and info you need to use, go to the List for Online Medicare, Retirement, and Spouses Applications. To assist secure your identity, your Medicare card has a Medicare number that's distinct to you. If you did not get your red, white, and blue Medicare card, there may be something that requires to be fixed, like your mailing address.

If you have Medicare, you can get info and services online., Application for Enrollment in Medicare Part B (medical insurance) (paul b insurance medicare advantage).

Examine This Report on Paul B Insurance Medicare Advantage

If possible, your employer should finish Area B. If your employer is not able to complete Area B, please total that portion as best as you can on their behalf and send 1 of the following forms of secondary proof: Income tax form that reveals health insurance premiums paid - paul b insurance medicare advantage. W-2s showing pre-tax medical contributions.

So, what is the "benefit" of Medicare Advantage? The real advantages of a Medicare Advantage plan originated from its additional advantages, which frequently consist of vision, hearing, dental, choose fitness programs, and more. Some Medicare Benefit plans can even cover transport to doctor sees, over-the-counter drugs, and some preventative services that promote health and health.

Some costs do not count towards this, such as premiums, Part D Read Full Report expenses, and some out-of-network charges. Medicare Benefit plans can be found in different types, including health care organization strategies (HMOs) and preferred supplier organization strategies (PPOs). you can try here These are the two most typical types of Medicare Advantage prepares, and each one comes with different advantages, rules, and constraints on the types of protection and service providers you can gain access to.

The Only Guide for Paul B Insurance Medicare Advantage

HMOs normally need you to pick a medical care provider. In addition, you should get all your non-emergency care from suppliers within the plan's network. PPOs, on the other hand, permit you to check out any doctor that accepts your plan, however you might pay less when you visit a company in your network.

It permits you to choose the benefits that matter to you, such as vision, oral, hearing, and more. Some Medicare Advantage options can also assist those with persistent illnesses better deal with the specific nature of their treatment. Medicare Advantage is a one-stop buy those seeking to streamline their health insurance experience.

Intrigued in finding out more about Medicare Advantage? Contact an Advise certified agent today at -LRB-833-RRB- 923-1869 (TTY: 711). They are certainly not a great fit for everyone. We are here to clarify why these seemingly too-good-to-be-true strategies have a less-than-stellar track record. There are several factors why check beneficiaries might feel Medicare Benefit plans are bad. Some policyholders can provide a list of disadvantages, while others might be pleased with their Medicare Benefit coverage. There is no such thing as a totally free Medicare plan (paul b insurance medicare advantage).

The Buzz on Paul B Insurance Medicare Advantage

So, what is the "benefit" of Medicare Advantage? The real benefits of a Medicare Benefit strategy originated from its fringe benefits, which frequently consist of vision, hearing, oral, choose physical fitness programs, and more. Some Medicare Advantage strategies can even cover transportation to doctor sees, over-the-counter drugs, and some preventative services that promote health and wellness.

Some costs do not count towards this, such as premiums, Part D expenses, and some out-of-network charges. Medicare Benefit prepares been available in various kinds, including health care company plans (HMOs) and chosen supplier company strategies (PPOs). These are the 2 most typical kinds of Medicare Advantage plans, and each one features various benefits, guidelines, and restrictions on the types of coverage and companies you can gain access to.

HMOs typically need you to choose a medical care service provider. In addition, you need to receive all your non-emergency care from service providers within the strategy's network. PPOs, on the other hand, enable you to check out any medical professional that accepts your strategy, but you might pay less when you check out a company in your network.

Fascination About Paul B Insurance Medicare Advantage

It allows you to choose the advantages that matter to you, such as vision, oral, hearing, and more. paul b insurance medicare advantage. Some Medicare Benefit alternatives can also help those with persistent health problems much better deal with the particular nature of their treatment. Medicare Benefit is a one-stop purchase those seeking to simplify their medical insurance experience.

Interested in discovering more about Medicare Advantage? Contact an Advise licensed representative today at -LRB-833-RRB- 923-1869 (TTY: 711). They are definitely not a great fit for everyone. We are here to clarify why these relatively too-good-to-be-true plans have a less-than-stellar reputation. There are numerous reasons beneficiaries might feel Medicare Advantage strategies are bad. Some policyholders can provide a list of disadvantages, while others may be satisfied with their Medicare Benefit protection. Regrettably, there is no such thing as a free Medicare strategy.